In the ever-evolving landscape of technology and social media, META Platforms, Inc. (formerly known as Facebook) has emerged as a compelling case study for value investors seeking growth at a reasonable price. This blog explores why investing in META has been a remarkable choice for those adhering to value investing principles, focusing on the company’s financial health, competitive advantage, strategic initiatives, and market position.

Financial Resilience and Growth Potential

At the heart of value investing lies the pursuit of stocks trading for less than their intrinsic values. META, despite its dominant position in the tech industry, has experienced periods of stock price volatility, providing value investors with opportunities to purchase shares at what many considered discounted rates relative to the company’s long-term growth prospects. As recently as November of 2022, META was trading at $88/share with an intrinsic value of around $270. This would be a margin of safety of 67%, which would be more than adequate for the majority of value investors.

A deep dive into META’s financials reveals a company with a strong balance sheet, robust free cash flow, and consistent revenue growth. Despite facing challenges such as increased regulatory scrutiny and competition, META has maintained a healthy profit margin. Its ability to generate substantial advertising revenue from its diverse portfolio of platforms (Facebook, Instagram, WhatsApp, and Oculus) underscores its effectiveness in monetizing its vast user base.

Competitive Advantage and Market Dominance

META’s competitive moat is arguably one of its most attractive features for value investors. The company’s vast network of users creates a powerful network effect, where the value of its social media platforms increases as more people use them. This has made it challenging for new entrants to compete directly with META, providing a level of market dominance that is hard to replicate.

network effect, where the value of its social media platforms increases as more people use them. This has made it challenging for new entrants to compete directly with META, providing a level of market dominance that is hard to replicate.

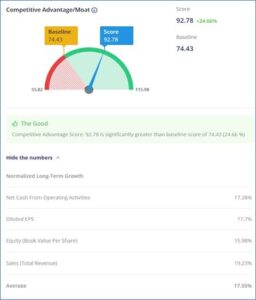

Furthermore, META’s investments in artificial intelligence and virtual reality indicate its commitment to maintaining a cutting-edge position in technology. The development of the metaverse and ongoing innovation in digital advertising are just two areas where META is poised to redefine the future of social interaction and online marketing.As far back as 2018 Meta has scored well with a current competitive advantage score of 92.78 which is well above our baseline of 74.43. DYF looks at growth rates for 4 key metrics (Cash Flow from Operations, EPS, Book Value per Share, and Sales) to provide a qualitative analysis of how durable is a company’s competitive advantage. META currently shows a normalized growth over the past 8 years of around 17.5%.

Strategic Initiatives for Sustained Growth

Value investors often look for companies that are not just resting on their laurels but are actively seeking ways to grow and adapt. META’s strategic initiatives, such as its significant investments in the metaverse and efforts to integrate e-commerce features across its platforms, signal its ambition to expand beyond traditional social media and advertising revenue streams.

These initiatives are not without risks, but they demonstrate META’s proactive approach to capitalizing on future tech trends, potentially opening new avenues for revenue growth and further solidifying its position as a tech powerhouse.

Market Position, Investor Sentiment, and Management

Despite facing headwinds, including public scrutiny over privacy concerns and the impact of global economic fluctuations, META’s core business remains strong. Investor sentiment has been buoyed by the company’s agile response to challenges, including enhancing privacy measures and diversifying its revenue sources.

Despite facing headwinds, including public scrutiny over privacy concerns and the impact of global economic fluctuations, META’s core business remains strong. Investor sentiment has been buoyed by the company’s agile response to challenges, including enhancing privacy measures and diversifying its revenue sources.

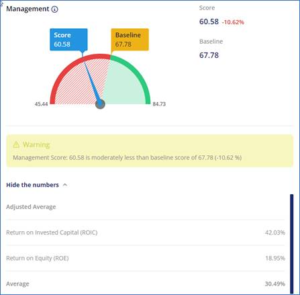

For value investors, META’s ability to navigate through these issues while maintaining its market leadership and financial health is a testament to the company’s resilience, management and long-term potential. As the digital landscape continues to evolve META’s strategic vision and execution capabilities position it well to capitalize on new opportunities, making it an attractive investment for those seeking value in the tech sector.Although not as compelling as the competitive advantage score, META has a respectable management score of 60.58. DYF leverages historical averages for ROIC (Return on Invested Capital) and ROE (Return on Equity) to see how well a company is managed. As of this writing, META is showing robust average return ratios for both ROIC and ROE, around 42% and 19% respectively. The lower score is a result of recent volatility with those ratios due to the large investments in the metaverse and its VR headsets.

Conclusion

For value investors, META Platforms, Inc. represents a unique blend of growth, resilience, and innovation at a reasonable price. Its strong financials, competitive advantage, strategic foresight, and robust market position underscore why META has been a great pick for those looking to invest in a company with both short-term stability and long-term growth prospects. As with any investment, due diligence and a clear understanding of one’s investment thesis are crucial, but for those who invested in META, the journey thus far has underscored the value of investing in companies that are shaping the future while offering compelling value today.