DYF Your Financial Ally

WHY ARE WE HERE?

We strive to dissolve the barriers that separate the average person from investing success!

At Ditch Your Fund Investing our goal is to make investing easy and accessible for everyone. We want to help you take control of your financial future and achieve your goals. We exist to give you the education and support you need to feel confident and empowered in your investment decisions. Join us and discover the benefits of investing for yourself.

We believe that everyone has the right to invest and grow their wealth, regardless of education or experience.

We’re here to help you break free from the outdated notion that a financial advisor or fund manager is essential to make smart investment decisions. With our support you can learn to invest on your own and earn higher returns than you ever thought possible.

The fact is most actively managed mutual funds like a 401k never beat the market. When looking at his own 401k, our founder Bryan Stockwell realized he could Ditch his fund manager and earn better returns by simply investing in fund that tracked the S&P 500. Frustrated by his 401k’s poor performance and wanting the same opportunities as the big investors, we at DYF discovered the methods of value investors like Warren Buffet, Benjamin Graham, and Charlie Munger.

We learned how to analyze historical data to better predict what companies might survive the proverbial storms. We came to understand the importance of patience, when to buy and when to wait. We invested our own money, tested theories, and are absolutely thrilled by the results of our work.

We won’t tell you what to buy or sell, but we will give you the tools and education you need to make informed investment decisions. With our approach you can increase your chances of achieving annual rates of return of 15% or more, all without paying outrageous fees.

We believe that anyone can use this approach to achieve wealth and financial security, whether you’re a seasoned investor or just starting out with $100.

Our Approach

We’re here to help you find great companies that trade below their fair market, or intrinsic value.

Intrinsic value is an important concept in the world of investing. It is the inherent worth or fundamental value of a company, separate from its market value or book value. The intrinsic value of a company is a measure of its true worth, based on its underlying fundamentals and potential for future growth. It is an objective and rational assessment of a company’s value, and can be used to guide investment decisions.

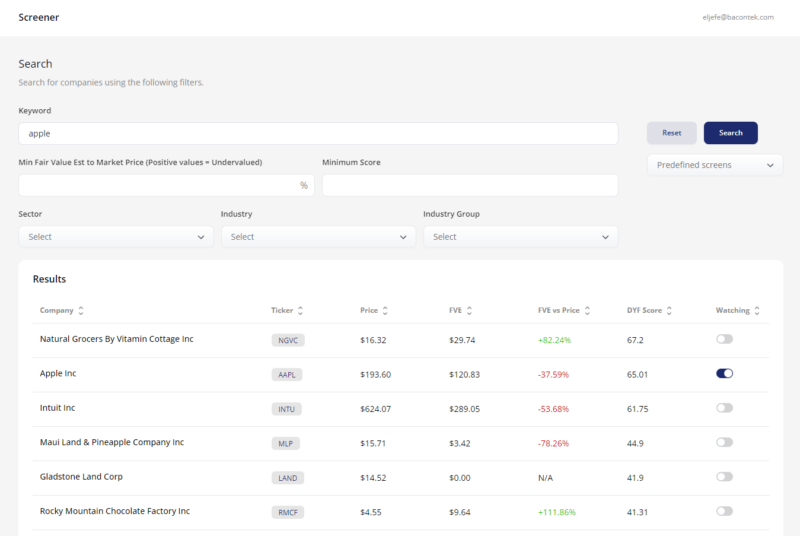

And if that were easy to do everyone would be doing it. Which is where we come in. Our proprietary software performs the painstaking and tedious research needed to identify wonderful companies for you.

We do this by examining overall performance over the last 8 years. This includes data like profits and debt, growth, how well a company is managed, and any advantage it has over competitors, to help predict viability into the future.

Then, after compiling multiple data points, we weight this information based on what most influences longevity to create an aggregate DYF score. This score indicates what company might be a good investment (the higher the score, the more wonderful the company), and gives you at a glance, information that would otherwise take hours to pull together.

The Truth

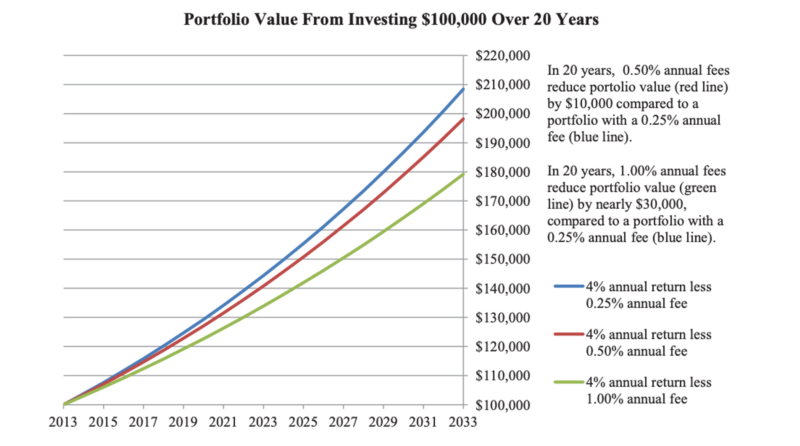

Actively managed mutual funds are expensive. They charge upwards of 3.17% each year for a variety of hidden and confusing fees.

Consider too, if your fund manager prioritizes your interests. Did you know that your fund manager will most likely collect his fees, even when his choices lose you money for the year? Let’s say your fund does poorly and earns only 2.5%. After he collects his 3% in fees, you’re in the negative. You lost money, but your manager didn’t.

And unless he or she is a fiduciary (someone legally obligated to act in your best interest), your fund manager is not obligated to act in your best interest. This means your manager could make deals with brokers that cost you more money, or worse lose you money, but result in higher fees or kickbacks for him. They are allowed to make deals that result in more money for them, but less money for you. They are allowed to use your money to pay higher fees for deals they stand to profit from, even if those deals lose you money.

And it’s all legal.

The Power Of Investing Long Term

One of the reasons long-term investing is a good idea is that it allows for the power of compound interest to work in an investor’s favor. When an investment is held for a long period of time, the compounded interest can significantly increase the overall value of the investment. For example, if an investor were to invest $1,000 at a 5% annual interest rate and hold the investment for 20 years, the compounded interest would increase the value of the investment to $1,716. This is significantly more than the $1,500 the investment would be worth if the interest was not compounded.

Furthermore, compound interest can help to offset the effects of inflation, which can erode the purchasing power of money over time. For example, if the rate of inflation is 3%, and an investment is earning 5% interest, the real rate of return (after accounting for inflation) is 2%.

While this may not seem like a large return, over the long term, the compounded interest can significantly increase the purchasing power of the investment.

That’s the great thing about what we’ve made at DYF Investing. We’re making it so easy to find and invest in strong companies that you’ll wonder why you didn’t make the switch sooner.

Ready to Transform Your Investment Journey? Wondering Where to Start?

Connect with us today to unlock the power of data-driven investing and embark on a journey towards financial empowerment.