For new investors the fair value estimate (FVE) might be one of the more difficult concepts to grasp. What is a fair value estimate? How is it different from market price? How is it calculated and who gets to decide? In this article we will;

- Define what is meant by a fair market value

- Explain why the fair value and market value are not the same

- Discuss how to apply the fair market value when making stock purchases

What is a Fair Market Value

It’s interesting that the fair value estimate can be so simple and yet so complicated at the same time. When doing an internet search, you’ll find several definitions of the FVE. For example Investopedia offers “Fair value is the estimated price at which an asset is bought or sold when both the buyer and seller freely agree on a price.”

A simpler one is offered by Morningstar who explains it is “the estimate of a stock’s intrinsic worth, or what the stock is worth in the long term”. Totally clear, right?

To understand the fair market value concept (also known as intrinsic value), it’s helpful to start with market value. Market value is what a stock is currently selling for. If you look up the ticker for any company on the DYF website or Yahoo Finance, you’ll see the current selling or market price. There are those, like investors that ascribe to the Efficient Market Theory, who believe what a stock is selling for IS what it’s actually worth, otherwise people wouldn’t be paying it. But behavioral finance teaches that people often make very irrational and emotion based decisions, both of which can significantly influence what people are willing to pay.

Was it Really Worth It?

To demonstrate this, think about game systems and popular toys near Christmas time. There’s often a strong sense of urgency or FOMO (fear of missing out) associated with purchasing certain gifts. And both of these can easily trigger irrational decisions that lead people to pay more than the gifts are actually worth. As an example, anyone remember the Tickle Me Elmo doll?

As Christmas 1996 approached and stores started to sell out of this fuzzy little guy, scalpers were charging up to $1500 to parents desperate enough to pay that much. Fueled by visions of seeing a beaming child Christmas morning, or maybe even more motivating was the fear of the tantrum if they

didn’t find one under the tree, parents were willing to do just about anything to get their hands on one. But with an MSRP of just $28.99, was it really worth the $1500 some were willing to pay?

If you buy one of these dolls today, it retails for about $45, nowhere near that 1996 price. This tells us it has not gained a lot of value from 1996 to now, and was likely never really worth $1500, otherwise it would still be selling for that much. But worth can be quite a subjective thing and maybe a child’s joy is worth that much to a doting parent.

So let’s look at an actual stock example. In November 2021, amid all the hype and excitement for electric vehicles, concerns for the environment, and confidence in Elon Musk, Tesla stock hit an all time high of just over $400 per share. Notice some of the words used, “hype, excitement, confidence”. These are words highly associated with emotion, and for a brief time people were willing to pay $400 for Tesla shares. That was the market value (just as $1500 was the market value of a Tickle Me Elmo doll for a few days).

But at the same time people were paying that much for Tesla stock, the intrinsic value or estimated fair market value was only $90. Because no one can ever predict exactly how well a company will do in the future, fair market value is always an estimate. But with Tesla we have the benefit of hindsight. As of this writing, Tesla stock sells for about $200 and has never again reached that $400 high.

So if you bought Tesla in late 2021 and had attempted to sell at any point since then, you would have and would continue to lose quite a bit of money. Which is again evidence that so far Tesla stock has never really been worth $400.

Market value then, the price people are willing to pay, can be heavily influenced by irrational and emotional factors, like desperately needing an Elmo doll or fear of missing out with Tesla. And as was demonstrated in both examples, from an investment point of view market value does not always equal fair value.

Applying the Fair Value Estimate

Estimating the fair value of a company is not based on emotions, trends, or fads, but instead on facts and analyst projections. There are a few models used to calculate an estimated fair value price, all of which are a bit complicated for the average person. For those interested, DYF Investing uses a discounted cash flow, looking at owner’s earnings instead of free cash flow to firm. But for those who aren’t, just know that DYF uses proven and well-established calculations to arrive at the FVE.

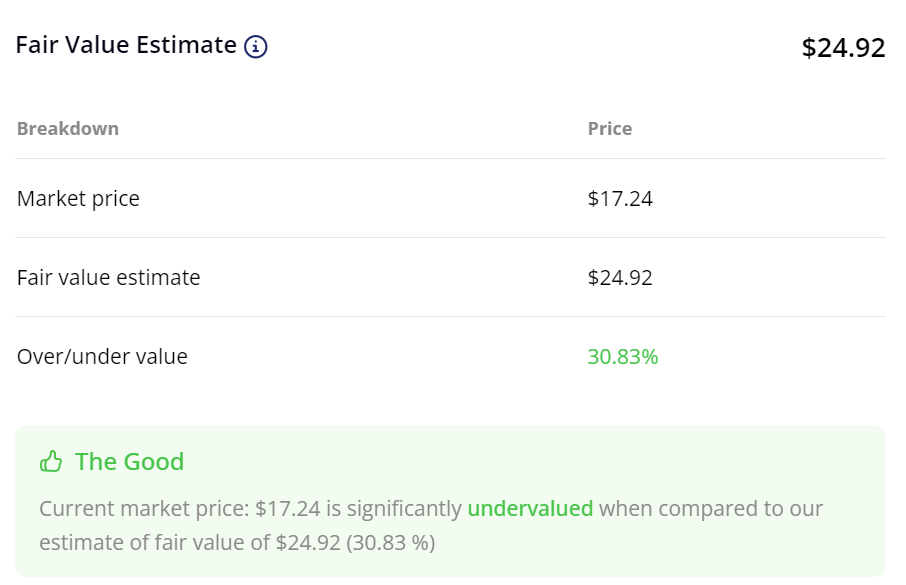

When something is selling for more than the fair value estimate it is said to be over valued. When it’s selling for less than the FVE, it’s considered under valued. But price is not where you want to start when looking for companies. Just because something is undervalued doesn’t mean it’s a good company to buy. You need to find those really good companies first, the ones that demonstrate consistent growth and profits, have a good cash flow and manageable debt, and are well defended against their competitors. For this, DYF has a score to help identify these potential companies. Once you’ve identified a wonderful company, then and only then should you start to consider price.

If the company you’ve chosen is under valued (selling for less than the fair market value), it could be a good time to buy. If it isn’t, most value investors will simply wait and watch. There are at times acceptable reasons for a good company’s stock to fall below market value (we cover this more in depth in another blog). When it does, if you’ve done your research and found a truly wonderful company, you may have found your value and purchasing opportunity.

We hope this helps demystify the FVE as compared to the current selling/market price. Understanding this concept is crucial when making confident investing decisions on your own. For full access to the information DYF Investing provides, analyzing fair market value and comparing it to current market prices, please consider subscribing to the website.