Article Summary;

- Who is Warren Buffett

- His investing success

- Why we follow his philosophy

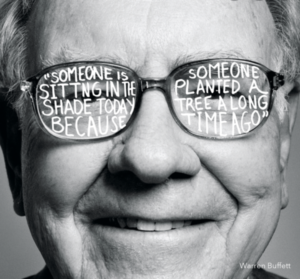

Why do we quote Warren Buffett so much?

Each time I sit to write for this blog, I almost always find myself looking for or inspired by something from Warren Buffett. Buffett is a smart man. He seems like a decent human, is one of the most successful investors in history, and frankly has some pretty awesome quotes.

“I tell students to go work for an organization you admire or an individual you admire, which usually means that most MBAs I meet become self-employed.”

The Man, the Investor

Currently 91 years old, Warren Buffett bought his first stock at 11 years old. When that stock price immediately dropped he held on, waiting for it to go back up. When it did, he sold it. But as that stock price continued to rise, he learned what might have been his first lesson in Value Investing; good companies are worth holding on to.

He began college at the age of 16 and by just 21 had earned a master’s degree in economics. At the New York Institute of Finance, he studied under investing guru Benjamin Graham. By applying what he’d learned under Graham, Buffet became a millionaire just a few years later when he first formed the Buffett Partnership, and then later joined Berkshire Hathaway.

To say he has been successful in investing might be an understatement, as his current worth is valued at $110.5 billion dollars. He is dubbed the “Oracle of Omaha” for his investing acumen and has solidly demonstrated the effectiveness of Value Investing, his investing strategy.

We want products where people feel like kissing you instead of slapping you.

Warren Buffett

Investing Strategy; Value Investing

Critics of Buffett often include day traders and those looking to play the odds and make a quick dollar. Which is one strategy for investing. But when we look at Buffet’s impressive track record, we have to take notice of his strategy and listen when he says

The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot.

Meaning successful investing involves patience and an understanding of what a “good pitch” looks like. It isn’t about market trends, emotions, or FOMO. It is intelligent and informed investing.

Speculation is most dangerous when it looks easiest.

Warren Buffet

…My dad had a business with [investment] books on his shelves, and they turned me on. This was before Playboy. If he was a minister, I’m not sure I would have been as enthused…” -Warren Buffett

In a 1996 essay, Bill Gates noted that he had “never met anyone who thought about business in such a clear way” and wrote about spirited conversations in which Buffett challenged him to think about companies from an entirely different perspective. He commented on Buffett’s obvious passion and how much he loves his work.

Gates’ comments also conveyed a humility that is seen in Buffett’s charitableness, which makes us like him even more. In 2006 he committed to giving away his entire fortune, and according to USA Today, between 2006 and 2017, donated $28 billion dollars to charity. He is said to look down on extravagant lifestyles and today still lives in the same home he bought back in 1958.

We Find Value in Warren Buffett

Warren Buffett is not the only investing expert out there, but he is an amazingly successful one. He has a proven track record that spans 80 years (if you count that first venture at 11 years old), and has earned him billions of dollars. He has donated to charity and even sought to improve health care for Americans.

He is passionate about his work, and at DYF Investing we feel he offers an incredible wealth of knowledge and experience. It is our goal to learn from and apply that knowledge so that our and your investing experience is as successful as possible.