DYF Investing Website User Journey

Welcome to the DYF Investing website user journey. In this short article we give an over view of a few key pieces of the website that includes;

- company search/lookup by name or by ticker

- how to use the company screener

- find information about each section of a company’s details page

- add companies to your watch list

- Identify potential value opportunities

- find educational videos

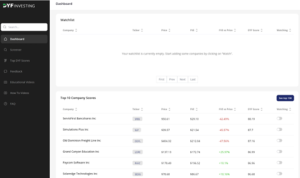

The Dashboard

The DYF Investing website was designed to simplify the process of finding value opportunities and investments. Once logged in, the first screen you’ll see is the Dashboard.

Here you’ll be see the companies you’ve added to your Watch List (top section), as well as see the overall Top 10 Company Scores section. This section tells you at a glance the 10 companies with the highest DYF scores.

The Dashboard will be your home base and the screen you refer to, to monitor the various investing opportunities you are tracking.

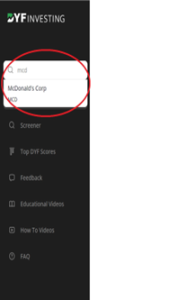

Search Feature

On the left side of the screen is the navigation menu that takes you deeper into the website. The Search bar allows you to search for companies by name or by ticker.

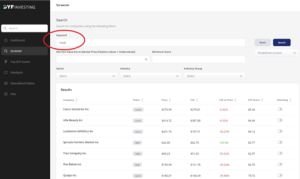

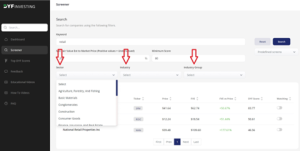

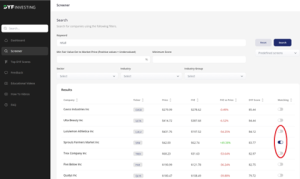

Screener

However, clicking the Screener allows you to do a broader search filtered by keyword, value potentials (Min Fair Value Est to Market Price), or DYF score.

When beginning your value investing journey, we encourage you to start with companies or industries you already know relatively well. For example, if you’ve worked in the retail business most of your life, you have a better understanding of how these types of business function on a fundamental level.

So, you might start by searching with the keyword “clothing” or “retail”. Notice that companies that fit that keyword will start populating in the section below.

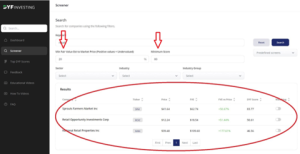

You can begin to refine your search by setting a minimum fair value estimate percentage and/or a minimum score. As you can see, the more parameters given, the narrower the list of companies.

How you define those parameters is up to you and your risk tolerance. In general, companies with a higher minimum fair value estimate percentage when compared to market price will carry less risk than companies with a lower percentage. Companies with a higher overall score generally represent a “wonderful company” potential.

You can further refine your search by designating a Sector, Industry, or Industry Group.

Once you’ve refined your search, you then get to decide which companies you want to research and look at more closely. Clicking on the company name will take you to the Company Details page.

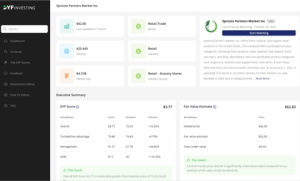

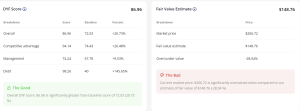

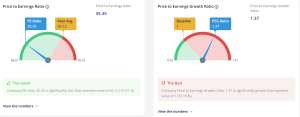

Company Details Page

This is where individual company information lives and includes all the values and scores needed to evaluate the company.

Each section on the Details page was chosen because it provides a piece of information that is key in the overall process of company valuation. These sections utilize complex algorithms to condense and simplify massive amounts of data, parsing them down to a few quick scores and data points.

Information for Each Section on the Details Page

Individual data sections on the Details page have an information button.

Clicking this icon will expand information to help you better understand any particular section and why it is important to your valuations. Consider each section as you make decisions about the company and its investment potential.

![]()

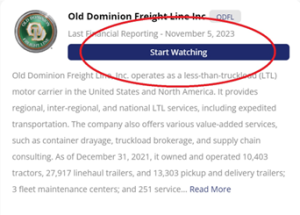

Create a Watch List

You’ll notice at the top right corner of the Details page, under the company name is a “start watching” button.

Clicking this button will add the company to your Watch List, and will now show up on your Dashboard each time you log in. Once you add a company to your Watch List, you will see that you are “watching” it every time it shows up in a list (the top 10 DYF scores list, or in the screener, for example).

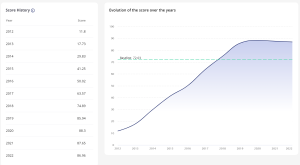

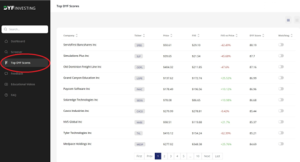

Companies with Highest DYF Scores

On the left-hand navigation bar, clicking the Top DYF Scores will take you to the 100 companies with the highest DYF scores.

We encourage you to start by researching companies or industries you already know well, but some may choose to start researching only the companies with the highest scores.

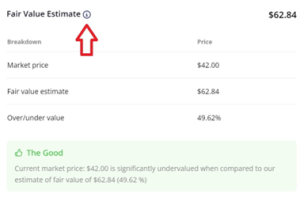

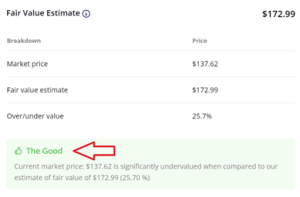

Identifying Potential Value Opportunities

The companies with the highest DYF scores represent the companies with the highest “wonderful company” potential. Once you’ve found a wonderful company you like and want to own as a long-term investment, you might watch this company and wait for it to go “on-sale”, or for the price per share to drop below Fair Value Estimate. Once this happens, it represents a value opportunity, and could be a good time to buy.

You should never make an investment decision based solely on the scores provided on our website. These scores represent the culmination of research and data consistent with value investing principles but should never replace sound investing processes and evaluations.

Educational Video’s

For more information on the concepts and principles associated with value investing check out the links to our educational videos, also located in the left-hand navigation bar.

At DYF Investing our goal is to break down the barriers that keep the average person from entering the world of value investing. We want to empower each person to make sound and confident investing decisions. If you like what we’ve shown you here, please consider subscribing to get started on your investing journey today.

[/fusion_text][fusion_button link=”https://app.dyfinvesting.com/#/subscription” title=”” target=”_self” link_attributes=”” alignment_medium=”” alignment_small=”” alignment=”center” modal=”” hide_on_mobile=”large-visibility” sticky_display=”normal,sticky” class=”” id=”” color=”custom” button_gradient_top_color=”var(–awb-color4)” hue=”” saturation=”” lightness=”” alpha=”” button_gradient_bottom_color=”var(–awb-color4)” button_gradient_top_color_hover=”var(–awb-color4)” button_gradient_bottom_color_hover=”var(–awb-color4)” gradient_start_position=”” gradient_end_position=”” gradient_type=”” radial_direction=”” linear_angle=”180″ accent_color=”” accent_hover_color=”” type=”” bevel_color=”” bevel_color_hover=”” border_top=”” border_right=”” border_bottom=”” border_left=”” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_right=”” border_radius_bottom_left=”” border_color=”” border_hover_color=”” size=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” fusion_font_family_button_font=”” fusion_font_variant_button_font=”” font_size=”” line_height=”” letter_spacing=”” text_transform=”” stretch=”default” margin_top=”” margin_right=”” margin_bottom=”” margin_left=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Join Now[/fusion_button][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

2 Comments

-

-

Susan Kelly

December 29, 2023Hey just wanted to give you a quick heads up. The text in your article seem to be running off the screen in Chrome.

I’m not sure if this is a formatting issue or something to do with web browser

compatibility but I thought I’d post to let you know.

The design look great though! Hope you get the issue fixed soon. Kudos

Kimberly DuBois

December 29, 2023Thank you Susan! We will give this some attention and get it corrected – we appreciate that feedback!